The Efficiency Review: Small Ripples in a Big Pond of Troubles

By Kansas Center for Economic Growth Senior Fellow Duane Goossen

Kansas lawmakers paid $2.6 million for a 257-page, recently-released efficiency review of state government. What should we make of it?

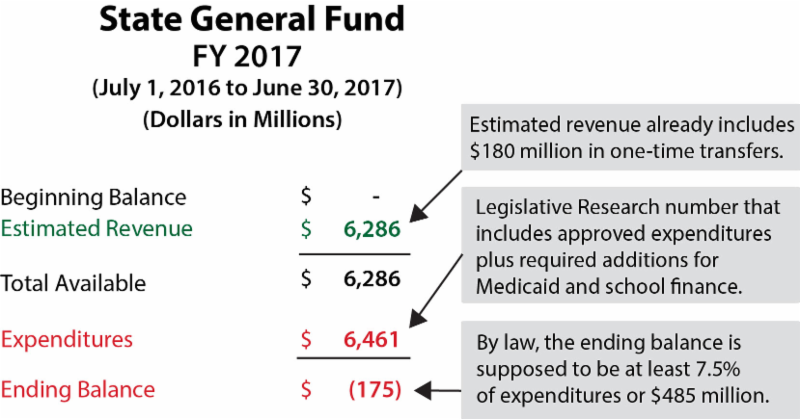

- The most important section of the report - budget process review - tells lawmakers to structurally balance the budget (recurring revenue equals expenses), and establish a rainy day fund, two critical financial practices that have been completely upended in Kansas by the 2012/2013 tax cuts.

- Even if lawmakers implement every single "efficiency reduction," Kansas will still not achieve structural budget balance or have a rainy day fund. $2 billion in potential savings may sound big, but that amount represents a cumulative 5-year total, a substantial share of which does not accrue to the general fund. Plus, the savings estimates for some of the components are just guesses, and likely too high. Further, items like the sale of surplus property, or depleting cash balances in school districts, produce only one-time dollars. And lawmakers will never, even in the wildest of dreams, ever implement all the recommendations.

- A large swath of the recommendations do not represent efficiency savings at all, just plain cuts. For example, $543 million in "savings" over 5 years, more than a fourth of the grand total, would be garnered by reducing health benefits to state employees and teachers. State employees would all be moved to a high deductible health plan. In this scheme, the state pays less and employees pay more; not a good move when the state struggles to fill positions at state hospitals and prisons.

- Several items actually propose an increase in spending in order to secure more revenue. Spend more to get more. Supposedly, about $50 million a year could eventually be garnered by hiring 54 new tax auditors and collection agents. If that is true, staff reductions of the last few years have seriously hurt the efficiency of the Department of Revenue, just as they have also damaged the operations of state hospitals and prisons.

- The review turned up some things that are worth doing - such as better coordination of insurance purchases, and energy savings ideas. Certainly state government should always work to provide the most efficient services possible with taxpayer dollars. However, items that might be classified as easy or "low-hanging fruit" were already accomplished long ago as the state struggled through the Great Recession and then grappled with reduced revenue as a result of tax cuts.

So, charge ahead, lawmakers. Implement every item that truly makes Kansas government more efficient. But remember that the key issue you face is not inefficiency. The 2012-2013 tax changes so damaged the state revenue stream that Kansas does not have enough income to meet even a conservative or "efficient" set of expenses. That's the real problem that must be fixed so that Kansas can once again invest in the future.